capital gains tax canada crypto

Any crypto-currency transaction will be taxed the same way as any other transaction for any commodity in the sense that a positive change in price gives rise to a Capital Gain 50 percent for tax rates etc. Yes the Canadian Revenue Agency CRA has issued official guidance stating that cryptocurrency is taxed as a capital gains asset which means you have to pay tax every time you trade sell or use crypto to pay for goodsitems.

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

If you buy crypto then sell it at a higher price than you bought it then that would count as a crypto capital gain.

. If you owned it for 365 days or less then you pay short-term gains taxes which are equal to income taxesIf you owned it for longer then you pay long-term gains taxes. If you hold crypto for a period longer than 12 months and then opt to sell or trade that crypto you will be subject to a long-term capital. But it also has another tax break.

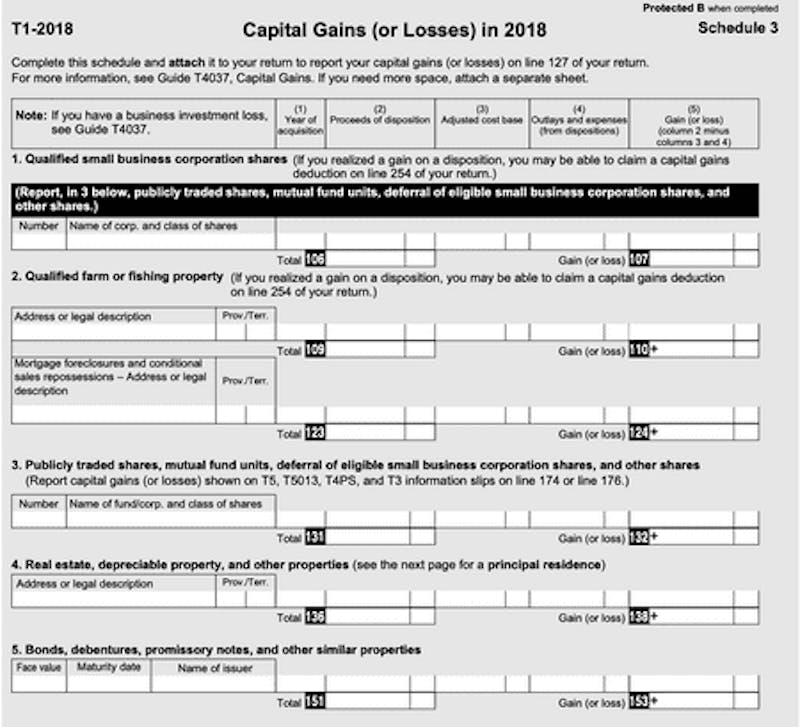

Can You Claim Crypto Losses On Taxes In Canada. Capital gains from the sale of cryptocurrency are generally included in income for the year but only half of the capital gain is subject to tax. Coinpanda generates ready-to-file forms based on.

Crypto tax rates range from 0 to 37 depending on several factors including whether your cryptocurrency is taxed as ordinary income short-term capital gains or long-term capital gains. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Crypto Capital Gains Tax Rate Canada.

For long-term capital gains tax purposes you are liable on short-term gains earned when your crypto becomes impure after holding for less than one year. The IRS requires that you track your crypto transactions throughout the entire year and then calculate and report your capital gains and losses on various IRS tax forms including. While 50 of capital gains are taxable 100 of business income is taxable.

Establishing whether or not your transactions are part of a business is very important. A negative change in price would result in a Capital Loss five percent to. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains.

Thats for the whole income including regular income. How is crypto tax calculated in Canada. Canada doesnt have a specific Capital Gains Tax rate and there is no short-term Capital Gains Tax rate or long-term Capital Gains Tax rate.

They taxed me on 50 of my earnings capital gains at a 2697 rate or roughly 135 on everything overall and im trying to figure out this have was normal or really high and what everyone is paying. Log in Sign up. Taxable gains occur at a tax rate the same as regular income tax rates at 1087 to 1730.

If the sale of a cryptocurrency does not constitute carrying on a business and the amount it sells for is more than the original purchase price or its adjusted cost base then the taxpayer has realized a capital gain. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. If you sell any cryptocurrency assets for less than the cost you paid for them you can count this as a capital loss and use it to offset your total capital gains.

In Canada the CRA expects all Crypto-Currency transactions to be treated in the same manner as any commodity would which means any increase in the price produces a Capital Gain taxable at 50 and any losses would create a Capital Loss. In addition you should be aware of the superficial loss rule which means you cant claim capital losses on the same. Similar to many countries cryptocurrency taxes are taxed in Canada as a commodity.

Valuing cryptocurrency as inventory. Up to 25 cash back Cryptocurrency tax rates depend on your income tax filing status and the length of time you owned your crypto before selling it. Remember you will only pay tax on your gains not your entire crypto investment.

Canadian citizens have to report their capital gains from cryptocurrencies. Youll only pay Capital Gains Tax on half your capital gains. You can calculate this in a couple of different ways but the easiest way is to add up all your capital gains and then halve the amount.

This means that 50 of your gain is added to your income for the year and charged at your marginal rate. However it is important to note that only 50 of your capital gains are taxable. So if anyone else has any experience with cryptocurrency taxes in Canada and what percentages youve been taxed at before or for 2021 id really appreciate the help.

Capital gains tax rate. Capital gains tax report. 5 tax considerations for Canadian investors.

In most jurisdictions capital gains taxes. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. This 100 free-of-charge service enables users to quickly generate accurate and organised.

I got it wrong. A simple way to calculate this is to add up all your capital gains and then divide this by 2. Instead your crypto capital gains are taxed at the same rate as your Federal Income Tax rate and Provincial Income Tax rate.

Note that only 50 of capital gains are taxable. Only half your crypto gains are taxed. However just as only 50 of capital gains are taxed only 50 of capital losses can be deducted.

10 rows How Much Is Capital Gains Tax On Crypto. As another example suppose you sell that Ethereum for 4000 in Bitcoin and then use that 4000 of Bitcoin to buy a new car. Capital gains and crypto.

Capital gains and crypto currency Canada Book A Call.

Canada Calculate And File Bitcoin Cryptocurrency Taxes Coinpanda

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Cryptocurrency Taxes In Canada Cointracker

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Taxes In Canada Adjusted Cost Base Explained

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Tax Rates For Crypto Bitcoin 2022 Koinly

Canadian Cryptocurrency Tax Reporting For Exchanges And Users Taxbit Blog

Declare Your Bitcoin Cryptocurrency Taxes In Canada Cra Koinly

How To Cash Out Crypto Without Paying Taxes In Canada Apr 2022 Yore Oyster