ct sales tax exemptions

Military members stationed in Connecticut. Learn about the sales tax in Canada including the federal GST Provincial Sales Tax rates PST and the Harmonized Sales Tax HST.

Sales Taxes Association For New Canadians Nl

Sales of Food and Beverages at Schools and Care Facilities Exempt from CT sales tax.

. It reflects changes to the federal diplomatic tax exemption program made since the issuance of Policy Statement 932. Exemptions to the Connecticut sales tax will vary by state. Read the bulletin - Learn more about myconneCT.

UConns Sales Tax Exemption Letter from the CT Department of Revenue Services. Local tax rates in. 7 on certain luxury motor vehicles jewelry clothing and footwear.

The exemption for hybrid passenger vehicles will not apply to sales made on or. Bulletin 27 Exemptions From Sales Tax. Connecticut exempts winter boat storage and boat maintenance and repair services from sales and use tax CGS 12-407 2m 12-408 lD and 12-4111D.

Canadians pay a sales tax when they purchase most goods and services. The utility will then send a. This Informational Publication describes the sales and use tax exemption for purchases and leases of fuel-efficient passenger motor vehicles and addresses purchases of accessories or service contracts in connection with a purchase or lease of a fuel-efficient vehicle.

Connecticut offers an exemption from state sales tax on the purchase. Filing Season - DRS asks that you strongly consider filing your Connecticut individual income tax return electronically. CT-EITC - If you filed 2020 Schedule CT-EITC Connecticut Earned Income Tax Credit along with your 2020 Form CT-1040 Connecticut Income Tax Return on or before December 31 2021.

45 on motor vehicles purchased by active duty US. To become exempt from sales tax on qualified items please fill out the online form. 1912 cars for sale.

Products that qualify for sales tax. You may owe Use Tax on taxable goods and services used in Minnesota when no sales tax was paid at the time of purchase. We also administer a number of local sales taxes.

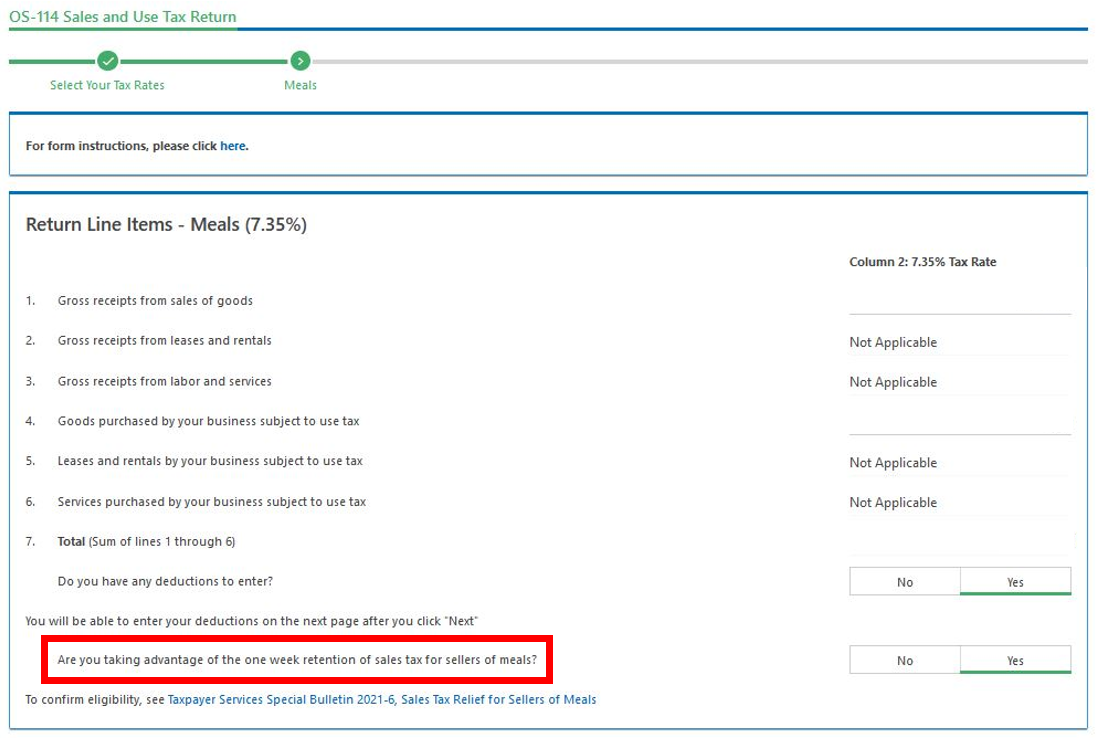

- Sales tax relief for sellers of meals. After years of difficult application processes and convoluted forms Connecticut has streamlined the process for nonprofit organizations eligible for sales and use tax exemptions. Nov 11 2021 Purpose.

You can learn more by visiting the sales tax information website at wwwctgov. Also known as a Value Added Tax VAT in. UConns Tax Collection Matrix for CT Sales Use Taxes Admission Taxes and.

As with all Sales Use Tax research the specifics of each case need to be considered when determining taxability. Based on your filing status your taxable income is. This Informational Publication describes two sales and use tax exemptions for purchases and leases of fuel-efficient passenger motor vehicles.

Ct sales tax exemptions. The 2021 CT Tax Amnesty Program offers a limited opportunity to make it right. 2022 Sales Tax Free Week dates are Sunday August 21 through Saturday August 27 2022.

Ct sales tax exemptions Tuesday April 19 2022 Edit. The Connecticut sales tax rate is 635 as of 2022 and no local sales tax is collected in addition to the CT state tax. The Connecticut Sales Tax is administered by the Connecticut Department of Revenue Services.

Amazon background check previous employer. Informational Publication 2015 22 Annual. 45 on motor vehicles purchased by an active duty US.

Instead of applying to a government. According to state statute Sales Tax Free Week begins on the third Sunday of August and runs until the following Saturday. Phone numbers for the Sales Tax division of the Department of Revenue Services are as follows.

Military member stationed in. Navy federal selling car with lien. The latest sales tax rates for cities in Connecticut CT state.

Your household income location filing status Exemptions can be claimed for each taxpayer as well as dependents such as ones spouse or children. Agile Consulting Groups sales tax consultants can be found on our page summarizing Connecticut sales and use tax exemptions If you have questions comments or would like to discuss the specific circumstances you are encountering in regard to this issue or. TAX DAY NOW MAY 17th.

Start filing your tax return now. To qualify for the corporate tax Connecticut accepts a copy of the federal Determination Letter as proof of tax exempt status. 12-41289 for sales and purchases of machinery equipment tools materials supplies and fuel used directly in the biotechnology.

There are exceptions to the 635 sales and use tax rate for certain goods and services. There are exceptions to the 635 sales and use tax rate for certain goods and services. 7 on certain luxury motor vehicles boats jewelry clothing and footwear.

Ct sales tax exemptions Friday February 11 2022 Edit. Purchases of Meals or Lodging by Tax Exempt Entities. This Policy Statement indicates the extent to which and the circumstances under which sales made to diplomatic personnel and diplomatic missions are exempt from Connecticut sales and use taxes and the documentation that retailers must maintain.

The base state sales tax rate in Connecticut is 635. Department of Revenue Services. UConns Tax Collection Matrix for CT Sales Use Taxes Admission Taxes and.

View examples of individual items that are exempt or taxable during Sales Tax Free Week. 44 rows Claim For Refund of Use Tax Paid on Motor Vehicle Purchased From Other Than a. Sales and Use Tax Exemptions for Beer Manufacturers Under a new law beginning July 1 2023 specified manufacturing-related sales and use tax exemptions are available to beer.

Purchases of Meals or Lodging by Tax Exempt Entities. 2020 rates included for use while preparing your income tax deduction. Ukraine war map live update.

CT Sales Use Taxes. UConns Sales Tax Exemption Letter from the CT Department of Revenue Services. Rates include state county and city taxes.

Sales Tax applies to most retail sales of goods and some services in Minnesota. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Back To School Sales Tax Holidays Starting Soon In Florida Texas And 15 Other States

Sales Tax How Sales Tax Is Calculated Pipedrive

Sales Tax Holidays Politically Expedient But Poor Tax Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

Sales Tax On Business Consulting Services

Sales Tax By State Is Saas Taxable Taxjar

10 Ways To Be Tax Exempt Howstuffworks

The Sales Tax Requirements Of Selling Into Canada

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

States Sales Taxes On Software Tax Software Software Sales Marketing Software

Know The Vote State Issues Forum To Discuss State Questions

Sales Tax Relief For Sellers Of Meals

How To Charge Your Customers The Correct Sales Tax Rates

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation